See the top picks for different types of life insurance and riders. This is the amount of money that would be paid Geico offers affordable life insurance policies through partners for term, whole, and universal life coverage.

Basic Life Insurance How It Works & Different Types

Learn about the types, costs, and benefits of life insurance and get a free quote online.

Compare and buy life insurance online with progressive life insurance by efinancial.

Compare term, whole and guaranteed acceptance life insurance options from liberty mutual. Get a free online quote and learn how to protect your family financially. Learn how life insurance can protect your loved ones and your financial goals. Compare different types of life insurance policies and get a quote online or contact a financial professional.

Life insurance helps your life’s moments live on. Whether it keeps paying the mortgage, maintains a current standard of living, pays off debts or pays for college, the life insurance you choose can be there when it’s needed most by your loved ones. Contact an agent about life insurance. Term life insurance is a solid choice for most people — it's predictable, temporary and covers you for the years you have the most financial responsibilities (think:

A mortgage or school tuition).

Term life insurance is typically sold in lengths of one, five, 10, 15, 20, 25 or 30 years. Coverage amounts vary depending on the policy but can go into the millions. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, How much does life insurance cost per month?

Buy life insurance plans and policies from lic of india avail tax benefits with multiple cover options. The best life insurance companies. Learn more about the best life insurance companies for your needs. Best life insurance companies ;

Best term life insurance companies;

Best whole life insurance companies; Massachusetts mutual life insurance co., or massmutual, is one of the largest life insurers in the country. Founded in 1851, it offers a wide range of products, from term life to No medical exam, just health & other info.

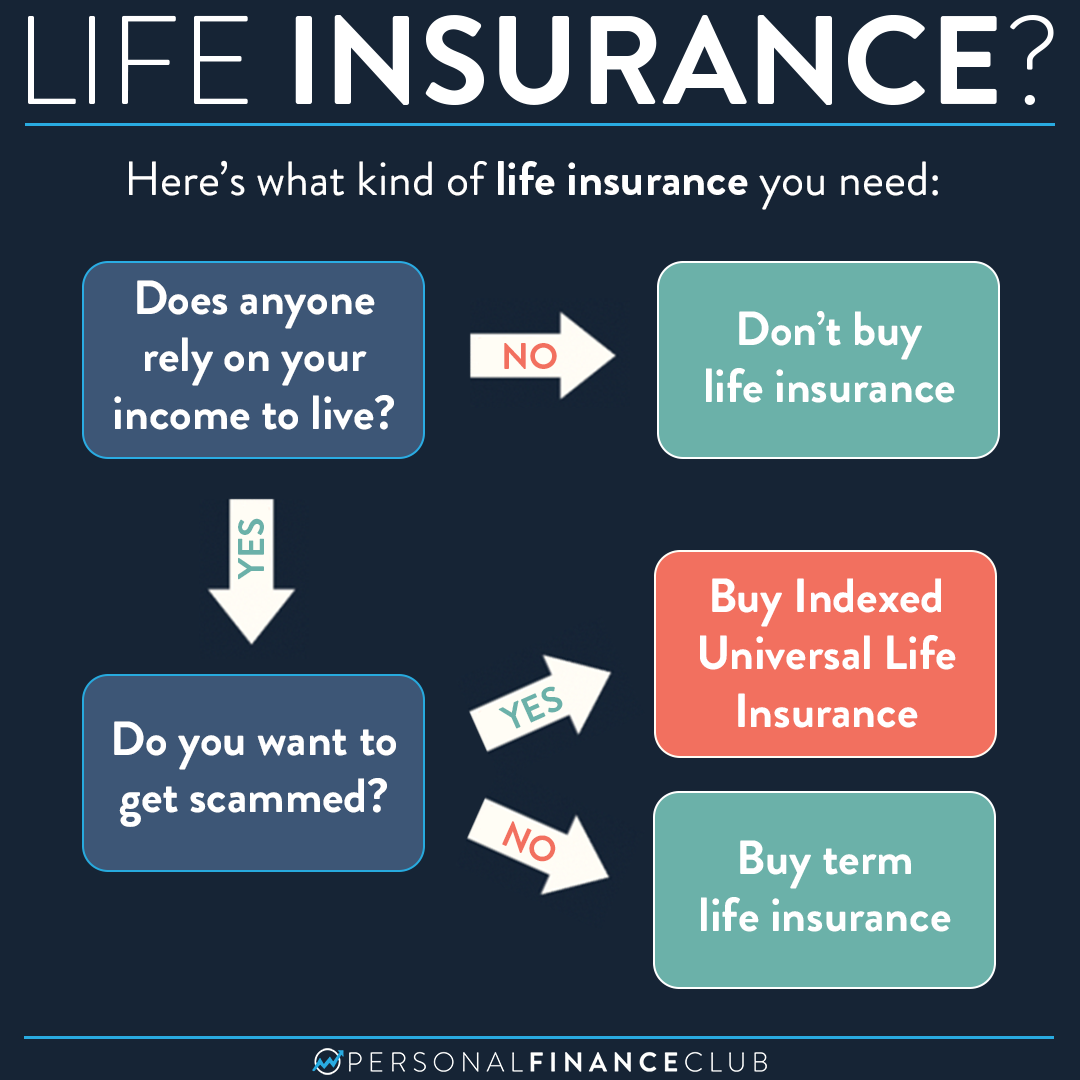

Compare free quotes and shop online for the right life, home, car, and disability insurance for you and your family. We're rated 4.8 out of 5 with over 3,950 reviews. The two major types of life insurance are term life insurance and permanent life insurance. Term life insurance allows you to lock in rates for a specific period of time, such as 10, 15, 20 or 30

Life insurance premium costs vary greatly depending on the type of policy, amount of coverage, and the age and health of the insured.

Term life insurance carries the lowest premium costs but, in Term life insurance quotes term life covers you for a set period of time, such as 10, 15, 20, 25 or 30 years. If you die within the term, the insurer issues the death benefit to your beneficiaries. This policy comes with the option to convert some or all of your coverage into a permanent policy without having to take a life insurance medical exam.coverage starts

Age impacts life insurance approval and rates, but senior citizens still have life insurance options. No medical exam, just health & other info. Age impacts life insurance approval and rates, but senior citizens still have life insurance options. Life insurance is a policy that can provide a financial safety net to loved ones after you pass away.

In exchange for regular premium payments, your beneficiaries will receive a designated sum, known as the death benefit, upon your passing.

Term life insurance is generally affordable with coverage lasting 10 to 30 years, while permanent life insurance can offer lifelong protection with a cash value component. Fidelity term life (policy form nos. You have two customizable term life insurance options at pacific life.customization options include riders like accelerated death benefit or chronic illness care. Of course, you can select

Use this term life insurance tool to get an idea of what term life insurance may cost you. Permanent life insurance (such as whole, universal or variable universal) is generally more expensive than term life insurance and requires a conversation with a professional to discuss the options available. When buying life insurance you would choose how many years your policy will last. This will also depend on the type of life insurance that you purchase — permanent insurance has a term that will last your whole life for example.