When it comes to planning for retirement, understanding the Ohio State Employment Retirement System (Ohio SERS) is crucial for thousands of public employees across the state. As one of the largest retirement systems in Ohio, Ohio SERS offers a robust set of benefits designed to provide financial security during your golden years. Whether you're a teacher, firefighter, or state employee, this system plays a pivotal role in ensuring that your future is as stable and comfortable as possible. By diving deep into its structure, benefits, and strategies for maximizing contributions, we can help you navigate this essential resource with confidence.

Ohio SERS isn't just a retirement plan; it's a lifeline for countless individuals who have dedicated their careers to public service. Established to cater specifically to state employees, this system has evolved over the years to meet the changing needs of its members. From offering competitive retirement benefits to providing tools for financial planning, Ohio SERS continues to adapt and grow. However, with so many options and rules to consider, it's easy to feel overwhelmed. That's why having a clear understanding of how Ohio SERS works is more important than ever.

This article aims to demystify Ohio SERS by breaking down its core components, addressing common questions, and offering actionable advice. Whether you're just starting your career or nearing retirement, this guide will equip you with the knowledge needed to make informed decisions about your financial future. So, let's dive in and explore everything Ohio SERS has to offer, ensuring you're prepared for the road ahead.

Read also:Driver Of The Day F1

Table of Contents

- 1. What Is Ohio SERS and Why Does It Matter?

- 2. How Does Ohio SERS Work?

- 3. Who Is Eligible for Ohio SERS Benefits?

- 4. How Much Should You Contribute to Ohio SERS?

- 5. What Are the Benefits of Joining Ohio SERS?

- 6. How Can You Maximize Your Ohio SERS Retirement?

- 7. Is Ohio SERS Enough for Retirement?

- 8. Frequently Asked Questions About Ohio SERS

- 9. Conclusion: Securing Your Financial Future with Ohio SERS

What Is Ohio SERS and Why Does It Matter?

Understanding the foundation of Ohio SERS is the first step toward making the most of its benefits. The Ohio State Employment Retirement System (Ohio SERS) is a public pension plan established to provide retirement, disability, and survivor benefits to employees of the state of Ohio. It serves as a safety net for those who have devoted their careers to public service, ensuring they have a reliable source of income during retirement.

Ohio SERS matters because it addresses one of the most pressing concerns for public employees: financial security in later life. Unlike private-sector retirement plans, which often rely solely on individual contributions, Ohio SERS combines employer contributions, member contributions, and investment earnings to create a stable and predictable income stream. This unique structure makes it an invaluable resource for anyone looking to retire comfortably.

Additionally, Ohio SERS offers more than just retirement benefits. Members can also access disability benefits if they become unable to work due to illness or injury, as well as survivor benefits that protect their families in the event of their passing. These features make Ohio SERS a comprehensive solution for long-term financial planning.

How Does Ohio SERS Benefit Public Employees?

For public employees, Ohio SERS provides peace of mind by guaranteeing a steady income after retirement. Unlike Social Security, which may fluctuate based on legislative changes, Ohio SERS benefits are protected by state law, ensuring predictability and reliability. Furthermore, the system is designed to adjust for inflation, meaning retirees won't see their purchasing power diminish over time.

Another advantage of Ohio SERS is its flexibility. Members can choose from various retirement plans, each tailored to meet different needs and preferences. Whether you prefer a traditional pension or a defined contribution plan, Ohio SERS offers options that align with your goals and lifestyle. This adaptability ensures that every member can find a solution that works best for them.

Lastly, Ohio SERS fosters a sense of community among its members. By bringing together individuals from diverse backgrounds who share a commitment to public service, the system creates a network of support and collaboration. This collective spirit not only enhances the member experience but also strengthens the system as a whole.

Read also:Alianza Bucaramanga

How Does Ohio SERS Work?

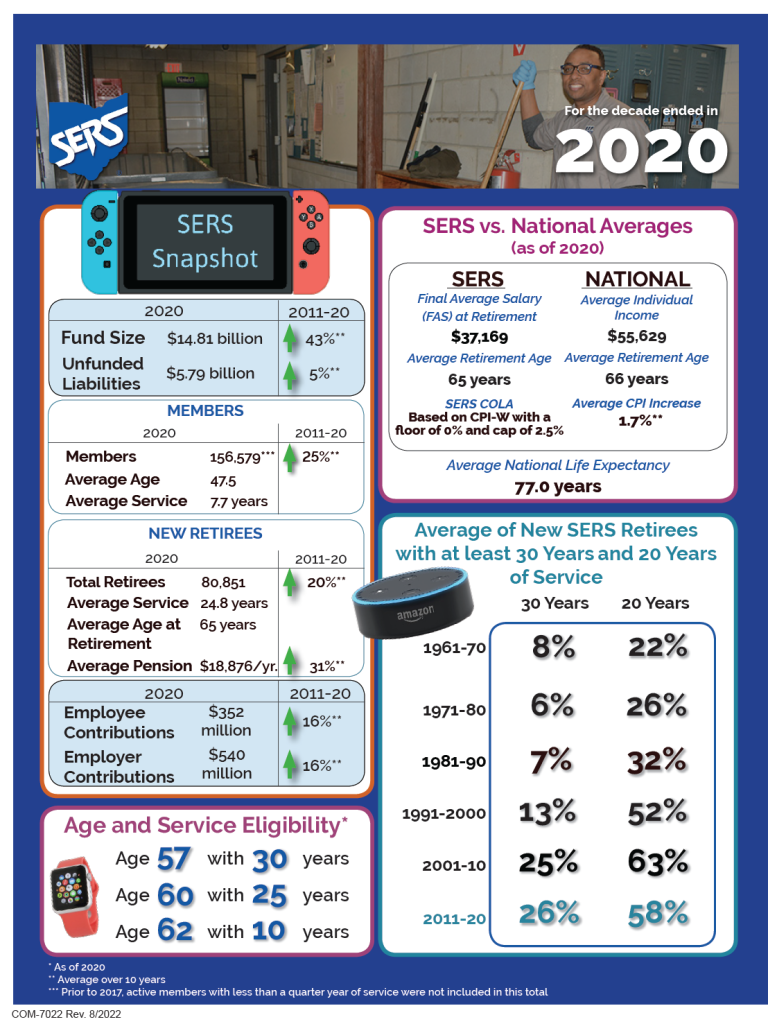

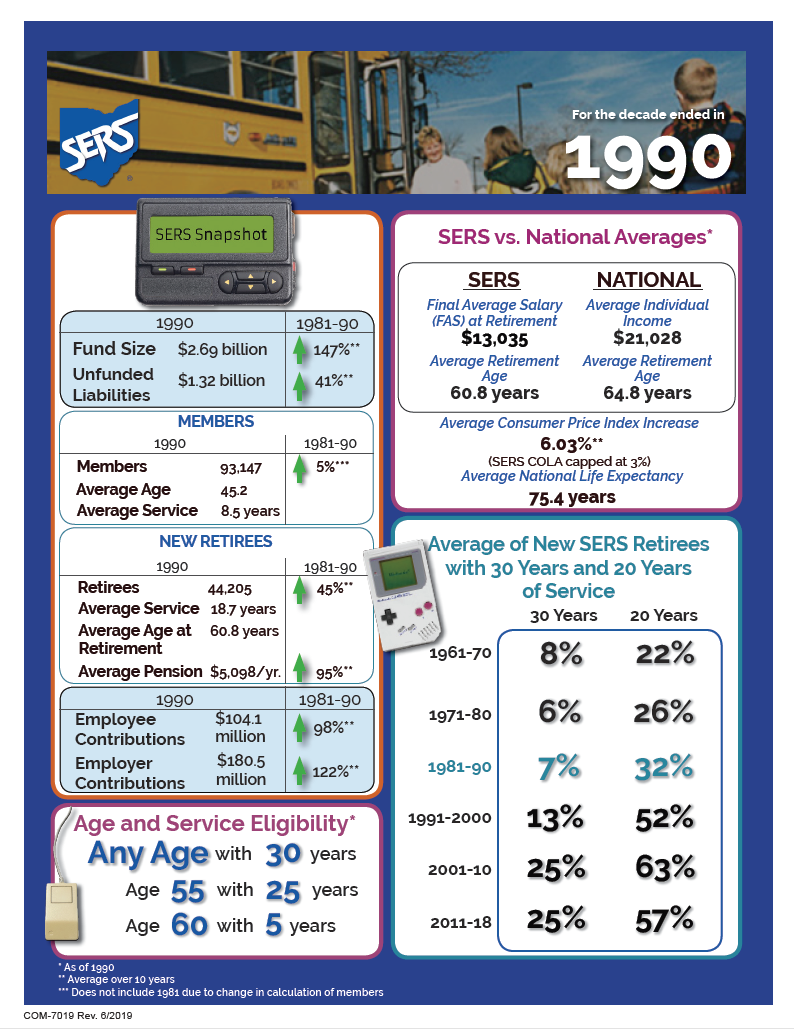

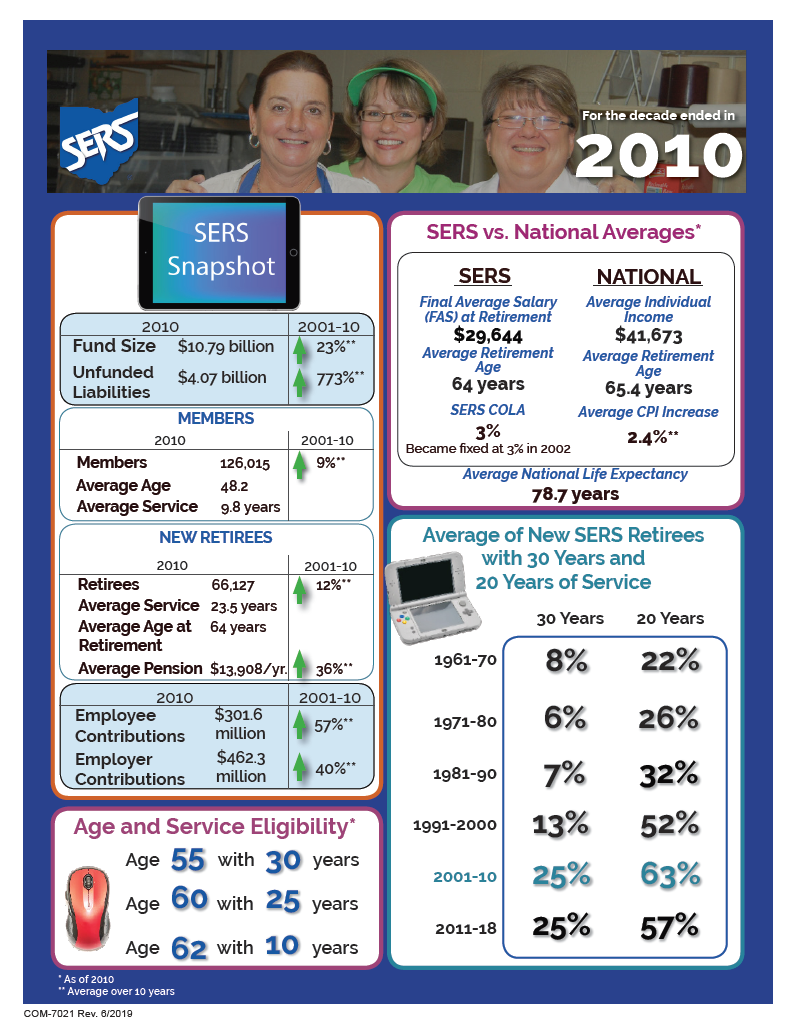

To fully appreciate the benefits of Ohio SERS, it's essential to understand how the system operates. At its core, Ohio SERS functions as a defined benefit plan, meaning that members receive a guaranteed monthly payment based on their years of service and final average salary. Contributions from both employers and employees are pooled together and invested in a diversified portfolio, generating the funds needed to pay out benefits.

When you join Ohio SERS, you begin contributing a percentage of your salary to the system. This contribution rate is determined by your employment classification and can vary depending on factors such as your job role and the year you joined. Employers also contribute to the system, ensuring that there is enough funding to cover all member benefits.

Once you retire, your Ohio SERS benefits are calculated using a formula that takes into account your years of credited service, your final average salary, and the retirement age at which you begin receiving payments. This formula ensures that members receive a fair and equitable payout based on their contributions and service.

What Happens to My Contributions?

Your contributions to Ohio SERS are carefully managed and invested to ensure long-term growth and stability. The system employs a team of professional investment managers who oversee a diversified portfolio of stocks, bonds, real estate, and other assets. This approach helps mitigate risk while maximizing returns, ensuring that the system remains solvent and able to meet its obligations to members.

In addition to managing investments, Ohio SERS also monitors economic trends and adjusts its strategies as needed to maintain financial health. This proactive approach ensures that members can trust the system to deliver on its promises, even in uncertain times.

It's worth noting that while your contributions play a significant role in funding your retirement, they represent only part of the equation. Employer contributions and investment earnings also contribute to the overall pool of resources, making Ohio SERS a collaborative effort between all stakeholders.

Who Is Eligible for Ohio SERS Benefits?

Not everyone qualifies for Ohio SERS benefits, so it's important to understand the eligibility requirements. Generally, any individual employed by the state of Ohio or a participating public entity is eligible to join Ohio SERS. This includes state employees, teachers, firefighters, police officers, and other public servants who meet specific criteria.

To become a member, you must complete an application and begin contributing to the system within a specified timeframe after starting your job. Once enrolled, you'll need to accumulate a minimum number of years of credited service to qualify for retirement benefits. The exact number of years required depends on your employment classification and the rules in place at the time of your enrollment.

It's also possible to purchase additional years of service credit through Ohio SERS, allowing you to increase your retirement benefits. This option is particularly useful for members who have taken leave from their jobs or worked in non-covered positions during their careers.

Can I Transfer My Credits from Another System?

If you've worked in another retirement system before joining Ohio SERS, you may be able to transfer your service credits to the new system. This process, known as reciprocity, allows you to combine your years of service across multiple systems, potentially increasing your retirement benefits. However, not all systems participate in reciprocity, so it's important to verify eligibility before proceeding.

To initiate a transfer, you'll need to complete the necessary paperwork and meet any applicable deadlines. In some cases, you may also need to pay a fee or make additional contributions to complete the process. While this can seem daunting, the potential benefits of combining your service credits often outweigh the costs involved.

How Much Should You Contribute to Ohio SERS?

Deciding how much to contribute to Ohio SERS is a critical decision that can impact your retirement benefits. The contribution rate for most members is set at 10% of their salary, although this percentage can vary depending on your employment classification and the year you joined the system. It's important to note that these contributions are mandatory, meaning you must participate to remain eligible for benefits.

In addition to the standard contribution rate, some members may choose to make voluntary contributions to enhance their retirement savings. These additional contributions can be invested in a separate account, allowing you to accumulate even more funds for your future. While not required, making voluntary contributions can provide extra financial security during retirement.

It's worth remembering that your contributions are just one piece of the puzzle. To maximize your retirement benefits, it's essential to consider other factors, such as your years of service and final average salary. By focusing on these areas, you can ensure that your Ohio SERS benefits are as robust as possible.

What Happens If I Stop Working Before Retirement?

If you leave your job before reaching retirement age, your Ohio SERS contributions will remain in the system until you're ready to claim your benefits. You have several options for handling your account during this time, including leaving it as is, rolling it over into another retirement plan, or withdrawing your contributions (subject to penalties). The best choice depends on your individual circumstances and financial goals.

Regardless of which option you choose, it's important to stay informed about your Ohio SERS account. Regularly reviewing your statements and updating your contact information ensures that you're always aware of your benefit status and can make timely decisions about your future.

What Are the Benefits of Joining Ohio SERS?

Joining Ohio SERS offers numerous advantages that extend beyond simple retirement savings. One of the most significant benefits is the guaranteed monthly income you'll receive after retiring. Unlike 401(k) plans, which depend on market performance, Ohio SERS provides a predictable payout that adjusts for inflation, ensuring your purchasing power remains stable over time.

Another key benefit is the disability coverage provided by Ohio SERS. If you become unable to work due to illness or injury, you may qualify for disability benefits that replace a portion of your lost income. This safety net can make all the difference during challenging times, helping you maintain your quality of life even when you're unable to work.

Finally, Ohio SERS offers survivor benefits that protect your loved ones in the event of your passing. These benefits ensure that your family remains financially secure, providing peace of mind knowing they'll be taken care of no matter what happens.

How Do Disability Benefits Work?

Disability benefits through Ohio SERS are designed to support members who become unable to perform their job duties due to medical reasons. To qualify, you must meet specific criteria, including providing medical documentation that demonstrates your inability to work. Once approved, you'll receive a monthly payment based on your years of service and final average salary.

It's important to note that disability benefits are subject to periodic reviews to ensure they remain appropriate for your needs. If your condition improves and you're able to return to work, your benefits may be adjusted or discontinued. However, this process is handled with care and consideration for your unique situation.

How Can You Maximize Your Ohio SERS Retirement?

Maximizing your Ohio SERS retirement requires careful planning and strategic decision-making. Start by ensuring you're contributing the maximum allowable amount to the system. While the mandatory contribution rate is 10%, making additional voluntary contributions can significantly boost your retirement savings.

Next, focus on accumulating as many years of credited service as possible. The more years you contribute to Ohio SERS, the higher your retirement benefits will be. This means staying in your job for as long as feasible and exploring opportunities to purchase additional service credits if necessary.

Finally, aim to increase your final average salary by advancing in your career or taking on higher-paying positions whenever possible. Since your retirement benefits are calculated based on this figure, even small increases can lead to substantial gains in your monthly payout.

Should You Purchase Additional Service Credits?

Purchasing additional service credits is an excellent way to enhance your Ohio SERS benefits. By adding more years of credited service to your account, you can increase your retirement payout and potentially qualify for early retirement options. However, this decision should be made carefully, as purchasing credits can be costly and may not always provide a positive return on investment.

Before proceeding, consider factors such as your current age, expected retirement date, and financial situation. Consulting with a financial advisor or Ohio SERS representative can help you determine whether purchasing credits aligns with your long-term goals.

Is Ohio SERS Enough for Retirement?

While Ohio SERS provides a solid foundation for retirement, it may not be sufficient to cover all your expenses. Depending on your lifestyle and financial goals, you may need to supplement your benefits with additional savings or investments. This is where creating a comprehensive retirement plan comes into play.

Start by assessing your anticipated retirement expenses and comparing them to your expected Ohio SERS benefits. If there's a gap between the two, consider exploring other savings vehicles, such as IRAs or 401(k) plans, to bridge the difference. Additionally, maintaining a diversified investment portfolio can help protect your assets from market fluctuations and ensure long-term growth.

Don't forget to factor in Social Security payments and any other sources of income you may have during retirement. By combining all these resources, you can create a robust financial strategy that meets your needs and supports your vision for the future.